A deduction is an amount of money withheld from a paycheck in order to make a payment to a third party such as insurance premiums, 401k savings, wage garnishments, etc. For further reading about deductions, see our payroll deductions and pre-tax vs. post-tax payroll deductions articles.

An explanation of deduction types in Patriot Software

To add a new deduction in the payroll software, see Company Level Deductions in Patriot Software.

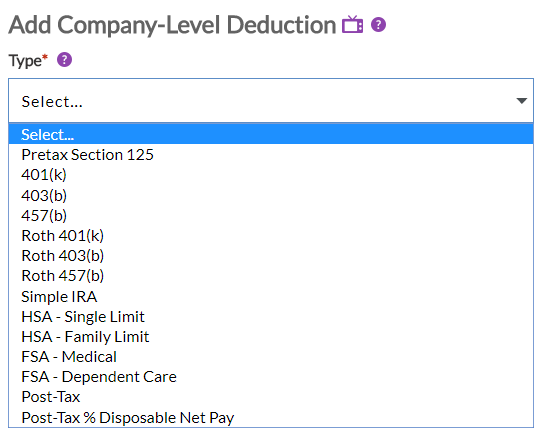

Settings > Payroll Settings > Deductions & Contributions > Deductions > Add New

When adding a new deduction to be used by the company, you will need to select which Deduction Type will be used. The Deduction Type will determine which types of tax are calculated on the deduction.

Once the deduction has been used in a payroll, the Deduction Type cannot be changed. See the chart below for the taxability of each Deduction Type.

- Pretax Section 125: Used for employee benefit deductions paid through a Section 125 Plan.

- 401k: Used for employee contributions to 401(k) retirement savings plans. The deduction will automatically stop when it reaches the IRS defined annual limit.

- 403b: Used for employee contributions to 403(b) retirement savings plans. The deduction will automatically stop when it reaches the IRS defined annual limit.

- 457b: Used for employee contributions to 457b retirement savings plans. The deduction will automatically stop when it reaches the IRS defined annual limit.

- Roth 401k: Used for taxable employee contributions made to Roth 401(k) accounts. The deduction will automatically stop when it reaches the IRS defined annual limit.

- Roth 403b: Used for taxable employee contributions made to Roth 403(b) accounts. The deduction will automatically stop when it reaches the IRS defined annual limit.

- Roth 457b: Used for taxable employee contributions made to 457b retirement savings plans. The deduction will automatically stop when it reaches the IRS defined annual limit.

- SIMPLE IRA: Used for employee contributions to SIMPLE IRA savings plans. The deduction will automatically stop when it reaches the IRS defined annual limit.

- HSA Single Limit: Used for Health Savings Account employee contributions, and will cap the amount of tax-free deduction up to the current IRS-defined single HSA contribution limit. If you allow employees to contribute to a Health Savings Account (HSA), you will need to set up two deductions. One deduction type will be HSA Single Limit and the other type will be HSA Family Limit. This will ensure that the taxability of the deduction will be correct. The IRS places contribution limits on HSAs and has two different limits depending on whether the employee has single or family coverage.

- HSA Family Limit: Used for Health Savings Account employee contributions, and will cap the amount of tax-free deduction up to the current IRS-defined family HSA contribution limit (see above).

- FSA – Medical: Used for Flexible Spending Account employee contributions, which includes Medical FSAs and Individual Plan FSAs. This will cap the amount of tax-free deduction up to the current IRS-defined limit, but will not stop the deduction.

- FSA – Dependent Care: Used for Flexible Spending Account employee contributions to Dependent CARE FSAs. This will cap the amount of tax-free deduction up to the current IRS-defined limit, but will not stop the deduction.

- Post-Tax: Used for any deduction that must be included in taxable income. Examples of after-tax deductions would be loan repayments, child support deductions, employee purchases, and benefit deductions that are not included in a Section 125 plan.

- Post-Tax Percent of Disposable Net Pay: This deduction type is most commonly used with wage garnishments. The deduction will be calculated as a percentage of pay remaining after income taxes have been withheld.

Below is a summary of how employee income tax is calculated based on Deduction Type:

Is Deduction Taxed?

| Deduction Type Pretax Section 125 401k 403b 457b Roth 401k Roth 403b SIMPLE IRA HSA FSA Post Tax Post Tax % Net Pay | Social Security NO YES YES YES YES YES YES NO NO YES YES | Medicare NO YES YES YES YES YES YES NO NO YES YES | Federal NO NO NO NO YES YES NO NO NO YES YES | State Varies Varies Varies Varies YES YES Varies Varies Varies YES YES | Local Varies Varies Varies Varies YES YES Varies Varies Varies YES YES |