Background

IRS Publication 1141 allows employers to provide employees with an electronic copy of their Form W-2, as long as the employee has a way to receive the W-2 electronically, and has consented to receiving an electronic W-2 instead of a paper copy.

How an Employee Gives Electronic W-2 Consent in the Employee Portal

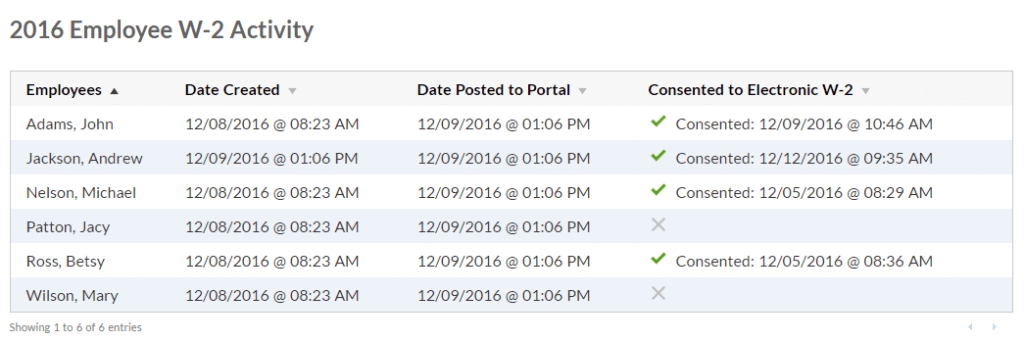

You can choose to make W-2s available electronically in PDF format to each employee in their employee portal ( www.payrolltime.com) . In order to provide an electronic W-2 to your employee instead of a paper copy, each employee will need to log in to their employee portal to give consent to only receive their W-2 electronically.

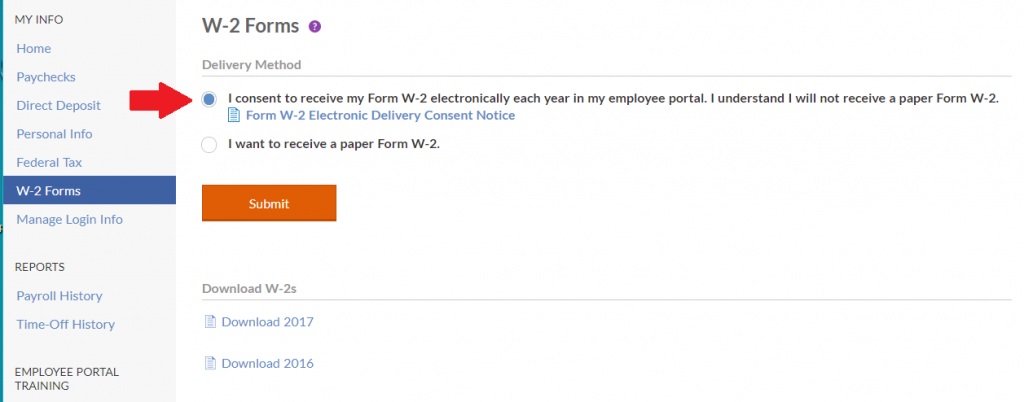

Once the employee has chosen their username and password, they will login to their portal, and click the “W-2 Forms” page. Here is the employee’s view.

By default, “I want to receive a paper Form W-2” is selected. The employee will need to select the first option “I consent to receive my Form W-2 electronically each year in my employee portal. I understand I will not receive a paper Form W-2” and click Submit to save their changes.

The employee will receive an automatic confirmation email from “Do-Not-Reply@approvepayroll.com” that their consent has been recorded. If the employee changes their selection back to “I want to receive a paper Form W-2,” they will receive another email confirming that their electronic consent has been revoked. You as the employer will also receive an automatic email notification when an employee consents or revokes consent.

Updating Employee Consent

The IRS requires that employees have an alternate method to consent or revoke their electronic W-2 consent. In the rare case where an employee submits their request to change their consent in writing outside of their employee portal, you can update their consent on their behalf, as long as they have a portal login.