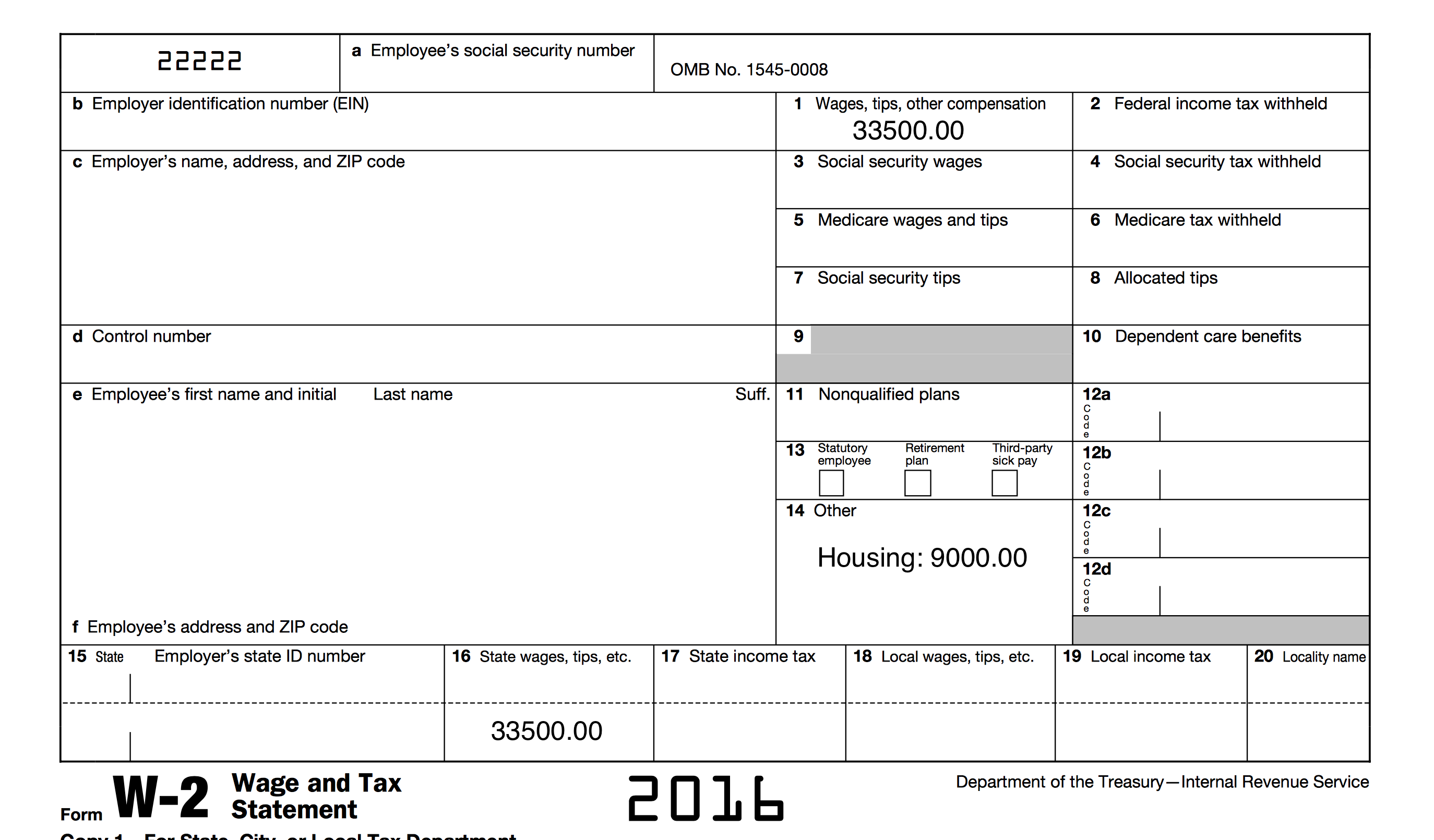

Example Federal Identification Number aka Employer Identification Number (EIN)

Federal Employer Identification Number (EIN). FEINs, or EINs, are used by employers and other businesses for tax filing and reporting purposes. FEINs are business’s unique nine-digit number on documents, the IRS can easily identify your company.

Below are some examples of "Proof of Federal ID / EIN"

- IRS SS-4

- Recent Quarter 941

- Prior W2 or W3

- IRS Tax Notice/ Penalty

Click Here. If you need to apply for a Federal ID Number with the IRS

Schedule a few minutes with us to help. Click to Schedule.

Related Articles

NEW EMPLOYER INFORMATION BY STATE

NEW EMPLOYER INFORMATION BY STATE If you are a new employer and need information to set up your payroll, we have created state-specific information to get you started. Just select the state you are in, and you will be taken to all new employer ...Employee Portal: Editing Federal Tax Withholding

Editing My Federal Tax Withholding www.payrolltime.com You can view and make changes to your federal tax withholding in your employee portal. From the main page, click “Federal Tax.” You can view your federal tax settings and history of previous W-4 ...Example Bank Letter To Validate Business Banking Account

If a bank letter is requested from your bank, below is an example of needed items in the letter on official bank letterhead. Copy and paste to email from below To Whom it may concern: The following information is to verify the business checking ...Viewing Quarterly Tax Filing Returns

You can find copies of your company tax filings under: Reports > Payroll Tax Reports > Tax Filings For each quarter that we file your payroll taxes, you can view details of all company tax filings and reconciliations for federal, state, and local ...Editing Employee Tax Information

Payroll > Employees > Employee List > Click the Employee Name > Taxes > Edit. Federal Filing Filing Status: By default, the filing status will be Single. Choose the correct filing status in the drop-down list as specified on the employee’s Form ...