When you void a check, you will reverse the payment made to the employee, including earnings, deductions, contributions, and all taxes. You can void multiple checks at a time. Note: If you are a Full-Service Payroll customer, you may only void checks that have not yet been included in tax filings.

Payroll > Payroll Tasks > Void Checks

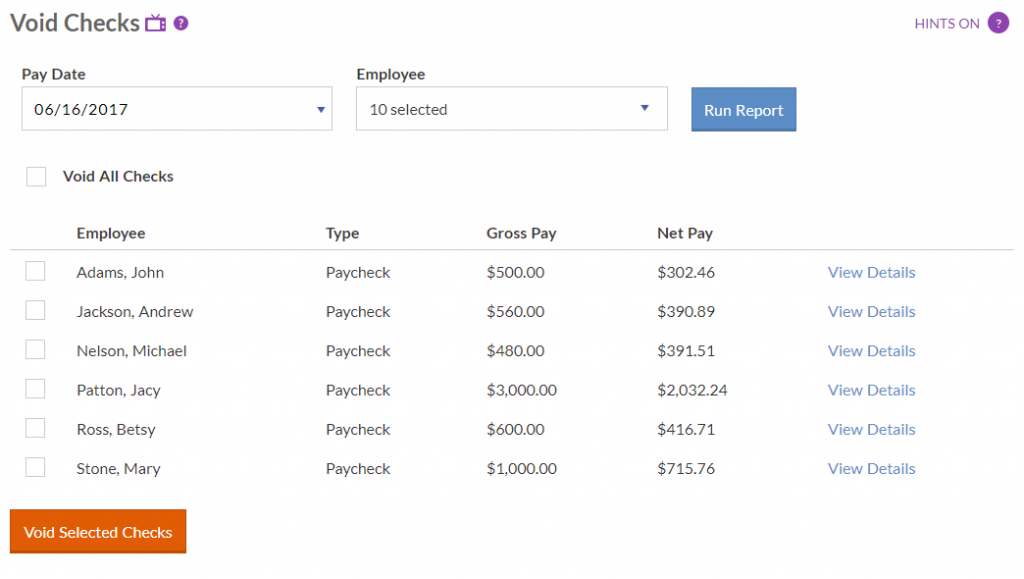

- A list of checks that are available to void will appear. If you have our payroll tax filing service, you will not be able to void checks from past tax periods that have already been filed. If needed, you can select a different pay date (back to the previous month), and click “Run Report.”

- You can click “View Details” beside each check to confirm this is the check that you want to void.

- Check the box beside each check to void, and click “Void Selected Checks.”

- A confirmation screen showing the paycheck detail will appear with a confirmation asking “Are You Sure You Want To Void These Checks?” Click Yes to void the checks. Click No to return to the payroll detail screen without voiding.

- In the Payroll Register and in Employee Check History, you will see that the check has been voided in red lettering at the top of the check, and the date the check was voided.

You can also void a single check directly from a report:

Payroll > Reports > Payroll Reports > Payroll Register

- Select the pay date range to find the check you want to void.

- At the bottom of the check detail, click the “Void This Check” link.

OR

Payroll > Employees > Employee List

- Select the name of the employee whose check you want to void.

- Click the “Paychecks” link.

- Select the pay date range to find the check you want to void.

- At the bottom of the check detail, click the “Void This Check” link.

Once you have found the check you want to void, proceed with the confirmation screen in Step 4 above.

Voiding Direct Deposit Checks

If you use direct deposit through NatPay, you will need to contact NatPay Support at 800-284-0113 or email csr@natpay.com for assistance with reversing the direct deposit on a voided check.Please note: NatPay charges a $10 file reject fee for cancelling direct deposit. This Natpay fee is billed through Patriot Software in a future invoice.