Payroll Register Report

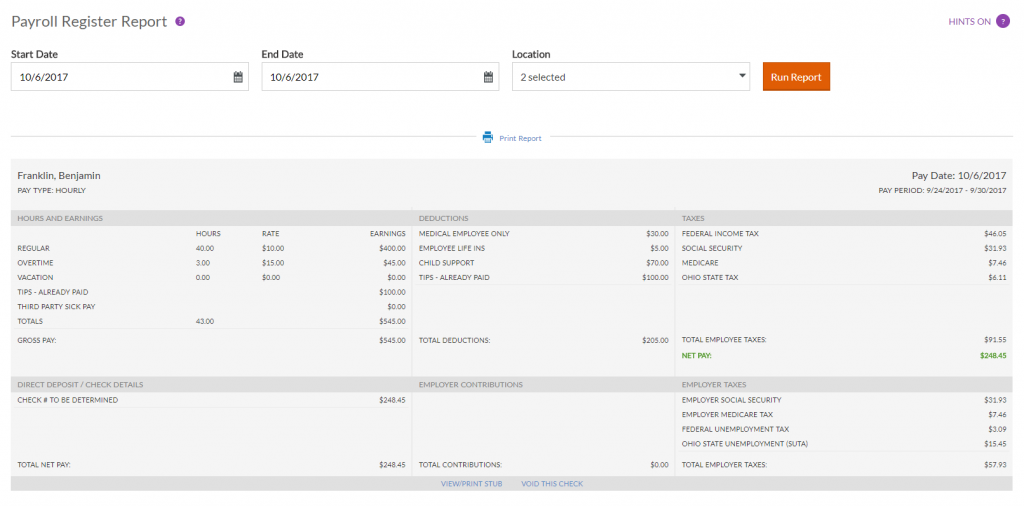

Hours & Earnings: Shows the number of hours and any additional money paid. Money taxed at the flat supplemental tax rate will appear in a separate Supplemental Earnings section. Non-taxable money will appear in a separate Non-Taxable section.

Deductions: All money deducted from employee earnings.

Employee Taxes: Any taxes withheld from employee earnings. If money is taxed at the flat supplemental tax rate, an additional Federal Tax line will appear showing the flat tax withheld.

Deductions Not Withheld: Any scheduled deductions that were not deducted from this paycheck because of low earnings. This section only appears if deductions were not withheld.

Deposits/Live Check Details: Details how net pay was paid to employee.

Employer Contributions: Any money contributed by the employer. These amounts do not affect employee earnings, and are for informational purposes only.

Employer Taxes: Any tax that the employer is responsible for paying.

How to Use the Payroll Register Report

To view paycheck history for a single employee:

- Payroll > View Employees > Click the employee’s name in the list.

- On the employee’s main screen, click the Paychecks link.

- The employee’s most recent paycheck will display. To view a check for a specific pay date or range of pay dates, enter the paycheck date range, and click Run.

- To view and/or print the employee’s actual pay stub, click the View/Print Stub link at the bottom of each paycheck detail. A file will be available to download.

To view paycheck history for a group of employees:

- Reports > Payroll > Payroll Reports > Payroll Register.

- The payroll register for the most recent pay date will appear. To change the pay date or view a range of pay dates, enter the paycheck date range.

- If your business has more than one location, you can filter by Location.

- Click Run Report

- To view and/or print the employee’s actual pay stub, click the View/Print Stub link at the bottom of each paycheck detail. A file will be available to download.

Related Articles

How To Void A Paycheck

When you void a check, you will reverse the payment made to the employee, including earnings, deductions, contributions, and all taxes. You can void multiple checks at a time. Note: If you are a Full-Service Payroll customer, you may only void ...Payroll Process 3 of 3: Print Paychecks or Stubs

Payroll Process Step 3 – Print Paychecks When you click “Approve” in Step 2, your payroll has been finalized. The third and final step in the payroll process is to print your paychecks or pay stubs. You can print your checks now, or come back ...Paycheck History Report Per Employee Per Paycheck

The Paycheck History report shows individual paycheck detail for checks processed. Paycheck detail includes hours, earnings, employee taxes withheld, employer taxes owed, deductions, and contributions. It also shows any scheduled deductions that ...Payroll Detail Report

The Payroll Details report shows all payroll activity for employees, including prior payroll history entries, payroll updates, and paychecks processed. You can view one employee or all employees, and select the pay date range. This report is ...Deduction History Report

The Deduction History report shows employee payroll deductions that have been deducted within a specific pay date range. For example, this report is helpful for confirming the amount of benefit deductions collected when reconciling benefit invoices ...